ECONOMICS & SUSTAINABILITY:

BUSINESS MODEL, STRUCTURE, GOVERNANCE, AND RISK

ECONOMICS & SUSTAINABILITY:

BUSINESS MODEL, STRUCTURE, GOVERNANCE, AND RISK

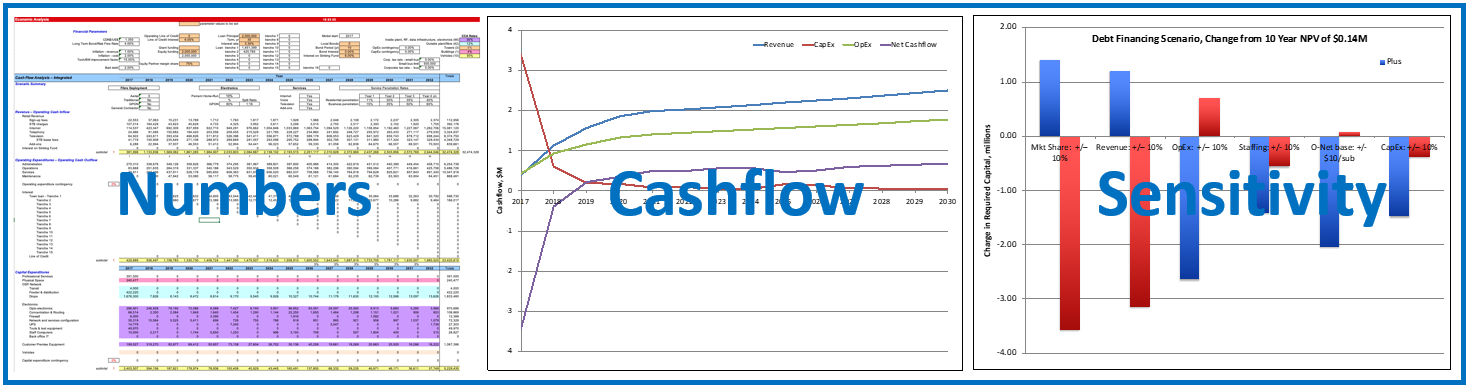

TaylorWarwick assists communities with market research and demand aggregation surveys, network design, partnership development and/or vendor evaluation and procurement to clearly identify, upfront, deployment and implementation issues and costs, funding and cashflow requirements, and other challenges the community will face. Using proven and comprehensive in-house business and financial modeling software, our Business Cases and Plans focus on ensuring long-term sustainability and appropriate governance and risk management strategies.

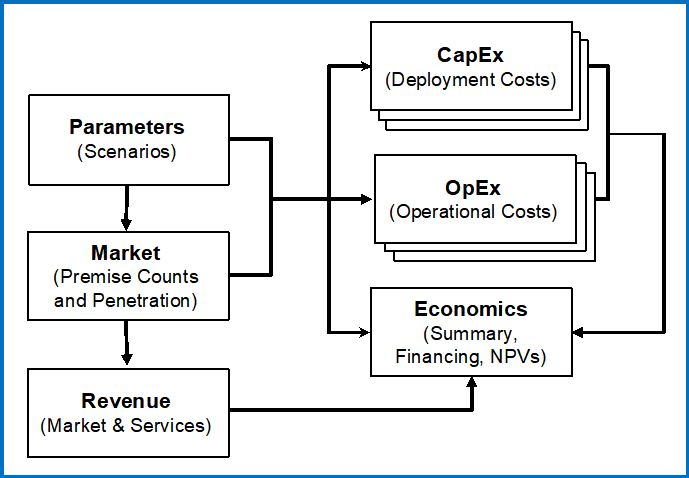

The accuracy of the TaylorWarwick financial models arises from both their detail and the careful modeling of deployments across time. Both wholesale and retail business models can be evaluated and all major revenue and cost components scale based on anticipated network and service deployment schedules. The overall structure and logic underlying these models is outlined below.

Parameters:

Most of the key model parameters are set on this sheet and the combinations selected determine the overall financial scenario projected. On this input sheet, one sets the financial, deployment, network, market (premise counts and penetration), services and pricing related parameters that the financial projections will be based on.

Market:

In this sheet, the deployment schedule and market penetration numbers are used to calculate how many installations and active subscriptions there are in each year of the 15-year model.

Revenue:

Takes the installation and market numbers and, together with the service mix and pricing, calculates revenue.

CapEx:

Based on the deployment schedule and market uptake, these sheets calculate the capital expenditures required each year. All equipment related pricing information (which is confidential) appear as parameters on these sheets. Multiple worksheets are required to account for the variations in active network equipment that might be deployed in different communities or regions.

OpEx:

Calculates operational expenditures based on service uptake and opex parameters. Multiple sheets are required when operational arrangements vary across a region.

Economics:

This is where all the projections come together and where the cashflow and financing requirements are calculated.

The importance of accurate business and financial planning to the overall success of any broadband undertaking cannot be underestimated. Though high-level estimates for the capital costs can be used in the early planning stages, detailed capital estimates resulting from a preliminary design are highly recommended. Not only will the associated costs be significant in any business model considered, they will largely be incurred upfront and put significant demands on both the initial funding requirements and on the implementation and start-up of the related network and service businesses. Some staging is possible, but any delays in business acquisition, services deployment, and even service penetration due to either deployment issues or increased activities by competitors will directly impact revenue generation and cashflow. Without sufficient capitalization, very careful planning and execution in the early stages of the project is critical if longer term sustainability is to be achieved.